MyIncCheck gives you the opportunity to rate incorporations by their fundamental data and your very own and individual criteria.

Earnings per share are especially important to you? MyIncCheck gives points to the incorporations depending on the actual or historical EPS values. Or are earnings before interest crucial? Than go with that, or both or any other of the 63 available fundamental values available.

MyIncCheck uses a 3rd party database which includes currently over 2000 US listed incs and 63 fundamental values, containing balance sheet, cashflow statement and income statement information. Historical data contains the annually released information of the last 7 years.

MyIncCheck offers two main features:

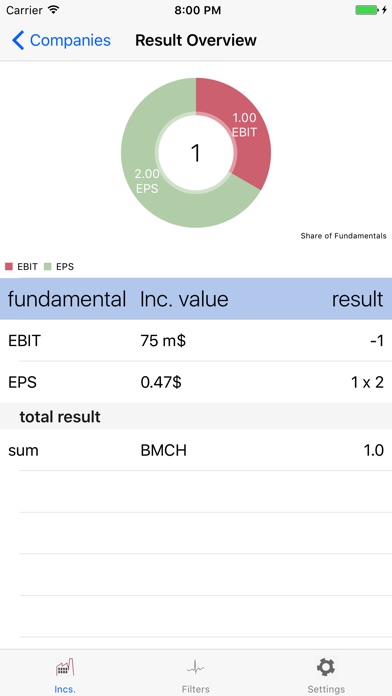

- Pick a bunch of corporations youre interested in and rate them point-based by your custom made filters(s.b.)

- search the database for corporations which matches your custom defined criteria

To do so, you can define filters which do the hard work of gathering information and calculation for you.

You can pick any amount of fundamental identifiers, combine them and set rules and operations for any single value. E.g.:

- Calculate the average of invested capital over the last 3 years. If the actual value of a rated Inc. is over 30 million $ give the the Inc 2 points. -2 if its below 1 million $.

- Check if the debt is ascending over the last two years. If yes, give the Inc -1 point.

- Check if the current assets are over 10 million $. If yes give the Inc. a point.

...

In the end, all single values are added up which results in x points for a certain corporation.

Once you configured a filter, you can rate any known corporations with it or search for Inc.s reaching at least x points given by the checker.

There is no need to sign in to the app or give away any personal information. It only needs access to the internet. The basic version is totally free and you can use any of the above features with only restrictions to the amount of simultaneously rated corporations.